Digital Experiences

Premium Experiences

Beyond the Final Whistle: How Can Sports Teams Use Mixed-Use Districts to Build Neighborhoods, Revenue, and Community?

The sports venue revenue model just got a complete rewrite… and the most forward-thinking teams? They’re already cashing in

I’ve spent 25 years helping sports organizations tell their stories through physical spaces. I’ve watched stadiums evolve from concrete bowls surrounded by parking lots into sophisticated brand theaters. But what I’m witnessing right now represents the most significant transformation I’ve seen in my career: the wholesale shift from building venues to building entire ecosystems.

The numbers tell a compelling story. Recent research projects that sports-anchored mixed-use districts will attract $100 billion in investment over the next 15 years. Teams operating within these districts can generate hundreds of millions in new revenue over the project’s lifetime, revenue streams that exist completely outside traditional league revenue-sharing agreements. The Star at the Dallas Cowboys have transformed their headquarters into a year-round mixed-use destination that delivers measurable returns for both the team and its partners, including a 37.4% brand equity lift against competitors and major sponsorship wins tied directly to on-site activations. When results like that hit the industry, every ownership group in professional sports takes notice.

But here’s what most people miss: this isn’t really about real estate. It’s about fundamentally reimagining what a sports franchise can be.

The 365-Day Problem: How to Solve Stadium Underuse and Unlock Year-Round Revenue?

For decades, professional sports teams have wrestled with an uncomfortable truth: their most valuable asset sits dark most of the year. An NFL stadium hosts maybe 10-12 events annually. Even a busy NBA arena might activate 100-150 nights per year. That’s a lot of expensive infrastructure generating zero revenue for significant stretches.

The traditional response was to book more concerts, host corporate events, maybe add a few college games. These helped, but they didn’t solve the fundamental problem. They were still separate activations rather than continuous engagement.

Mixed-use districts flip this equation entirely. Instead of asking “how do we use the stadium more?”, they ask “how do we leverage the stadium to create value every single day?” The answer involves restaurants that serve dinner whether there’s a game or not, office space that generates rent 365 days a year, hotels that house business travelers during the week and fans on game days, and residential units that keep the district alive at all hours.

This isn’t just about filling empty days on the calendar. It’s about creating an entirely new asset class. As one development expert recently noted, these districts can generate foot traffic of four to six million people annually with proper activation of an embedded demand driver unlike anything in traditional commercial real estate.

Is This The Hidden Sponsorship Goldmine? 365-Day Brand Opportunities in Mixed-Use Sports Districts?

Here’s where the revenue conversation gets really interesting. Traditional sports sponsorships are mature, well-understood, and increasingly expensive to secure. A jersey patch deal or naming rights package represents significant investment for brands, putting these opportunities out of reach for many potential partners.

Mixed-use districts fundamentally expand the sponsorship aperture.

Consider what’s possible: a brand that can’t justify the investment in a traditional stadium sponsorship can instead integrate into the daily life of a district, from branded hospitality spaces to immersive, experience-led activations that operate 365 days a year. At The Star, the Dallas Cowboys have transformed their headquarters into a mixed-use destination where sponsors plug directly into fan journeys through branded club spaces, interactive exhibits, and year-round partner zones that function as organic engagement touchpoints rather than one-off in-game moments. The result is sponsorship that behaves more like a living environment than a static sign, deepening brand connection and making the spend far easier to justify.

The shift from isolated sponsorship moments to immersive brand districts creates fundamentally different value propositions. When digital signage within venues can dynamically change sponsors for each event, and when the district itself becomes “a showcase for any type of business in that immersive experience,” as one sponsorship executive recently described it, you’re no longer just selling impressions. You’re selling ecosystem integration.

The Kansas City Current saw this firsthand when their sports-anchored district contributed to a 200% year-over-year revenue increase in 2024. That kind of growth doesn’t come from incremental improvements, it comes from opening entirely new revenue categories.

Selling What Doesn’t Exist Yet: How Do You Pre-Sell Premium Spaces and Sponsorships for Future Sports Districts?

This brings us to what I consider the most fascinating challenge in the mixed-use district era: how do you sell premium spaces and secure major sponsorships for buildings that haven’t been built yet?

Traditional approaches relied on architectural renderings, site plans, and a lot of imagination. Ask potential sponsors or suite buyers to envision what a space will feel like in three years, and you’re asking them to make million-dollar commitments based on blueprints and promises.

Our work with the A’s Ballpark Experience Center on their Immersive Cube™ project addressed exactly this challenge. By creating a 26.5-million-pixel shared experience where potential partners can step inside the future ballpark before construction begins, we’re collapsing the gap between promise and reality. It’s not about showing stakeholders what the venue will look like, it’s about letting them experience what it will feel like to host clients in a premium club, or how their brand will integrate into the broader district experience.

This matters enormously for mixed-use development because the sales cycle extends years before the ribbon-cutting ceremony. Teams need to secure commitments that fund construction. Sponsors need confidence that their investment will deliver returns. The more tangibly you can demonstrate the future value of these spaces, the easier it becomes to convert theoretical opportunities into signed agreements.

The Capital Structure Revolution: How Will Mixed-Use Districts Transform Sports Franchise Revenue and Valuation?

Perhaps the most underappreciated aspect of mixed-use districts is how they’re changing the financial structure of sports franchise ownership.

Traditional teams generated revenue through four primary channels: ticketing, media rights, sponsorships, and merchandise. These streams are mature and largely predictable. They’re also subject to league revenue-sharing agreements that limit how much any single team can pull ahead financially.

Real estate development attached to sports venues lives outside these constraints. When a team owns or has profit participation in the surrounding commercial development, that revenue stays with the franchise. It’s not split with other league members. It compounds differently. And it fundamentally changes valuation models.

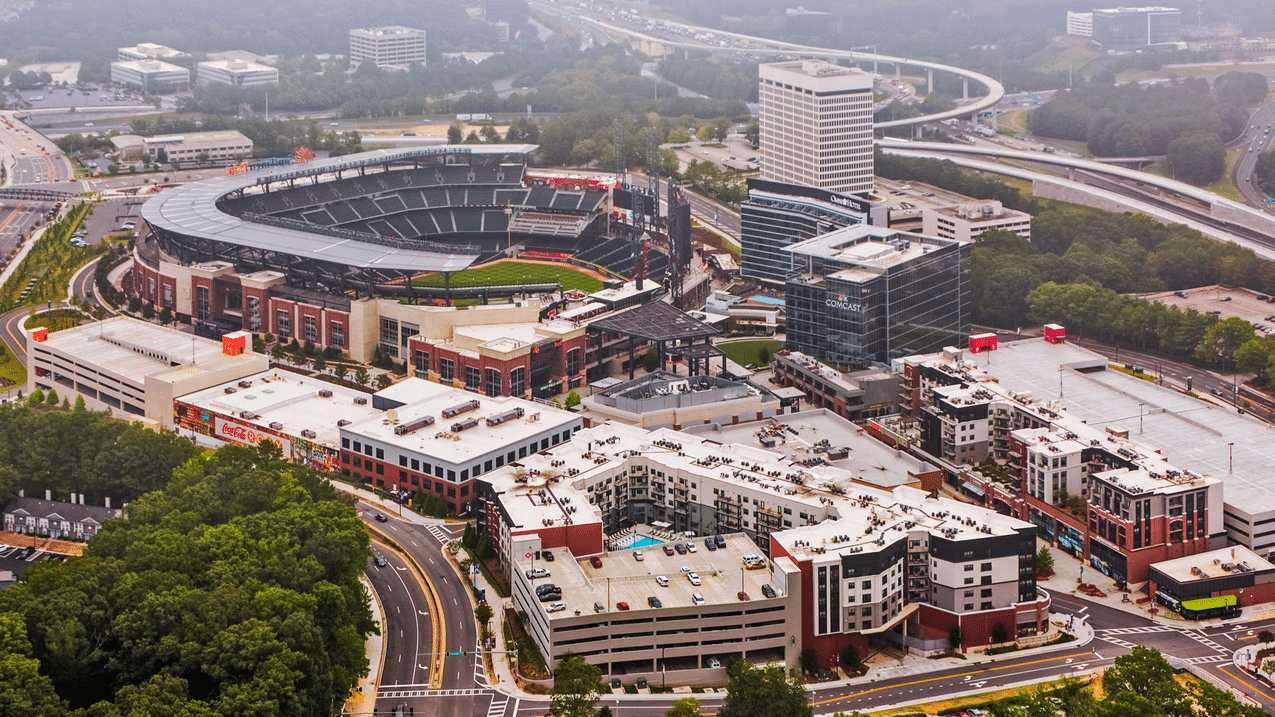

Consider that current bids for the Ottawa Senators reportedly exceed $1 billion, well above the team’s standalone valuation, largely because bidding groups recognize the mixed-use development potential around a potential new arena. Or look at the Atlanta Braves spinning out into a standalone publicly traded company combining the team and The Battery development. That structure would have been unthinkable a generation ago.

Traditional banks have historically struggled to finance these projects given their complexity and scale. But increasingly, institutional investors including insurance companies and private credit firms are recognizing sports-anchored districts as legitimate commercial real estate plays with sports-caliber returns. When financing structures can combine traditional bank debt with institutional placement and team equity participation, you create capital stacks that simply weren’t available for standalone stadium projects.

The Experience Design Imperative: How Will Blending Storytelling and Design Make Mixed-Use Sports Districts Work?

Here’s what keeps me up at night: I see teams rushing to build mixed-use districts without doing the foundational work that makes them succeed.

The most successful districts don’t just cluster amenities near a venue. They create coherent experience narratives that connect every touchpoint. When someone visits The Star, they’re not just going to restaurants that happen to be near the headquarters of the Dallas Cowboys, they’re engaging with an environment that extends the Cowboys brand story into retail, hospitality, and public space.

This requires thinking like an experienced designer, not a real estate developer. It means asking questions like:

- How does our district reflect our team’s identity beyond game days?

- What stories do we tell when the stadium sits empty?

- How do we create authentic connections with the local community rather than feeling like a corporate theme park?

- What makes someone choose to live here, work here, or visit here when there’s no game?

Too many projects start with land acquisition and feasibility studies when they should start with StoryMining, understanding what narratives will actually resonate with multiple stakeholder groups and create sustainable engagement. The difference between a district that becomes a beloved community hub and one that feels like a failed mall is almost always rooted in whether anyone articulated a compelling story before the first shovel hit the ground.

We’ve seen this play out across dozens of projects. The venues that become true destinations understand that technology, architecture, and programming are tools for telling stories, not ends unto themselves. The digital infrastructure matters enormously. The ability to transform spaces for different events? To create flexible multi-use environments? To update content as teams evolve but only if it serves a clear experiential purpose.

What Questions Should Leadership Be Asking About Mixed-Use Sports District Strategy and Operations?

If your organization is exploring mixed-use development opportunities, or if you’re watching competitors announce these projects and wondering what it means for you, here are the critical questions worth wrestling with:

On business model: Are we prepared to operate as a real estate company in addition to a sports franchise? Do we have the internal expertise, or do we need development partners who understand both sectors?

On timeline: Can we sustain the 5-10 year development horizon these projects require? Do we have patient capital, or are we under pressure for near-term returns?

On community: Have we done the stakeholder engagement to understand what the local community actually wants? Are we creating something that serves residents and visitors, or just game-day traffic?

On differentiation: What makes our district distinctive? In a market where dozens of similar projects are under development, what’s our unique value proposition?

On operations: Who maintains the public spaces? Who handles security, parking, programming? Have we structured agreements that clarify these responsibilities from day one?

On storytelling: Can we articulate why someone should care about this district beyond “it’s near the stadium”? What’s the narrative that brings it to life?

Beyond Revenue: What Are the Community Impacts and Civic Values of Sports-Anchored Districts?

I want to be clear about something: the financial case for mixed-use sports districts is compelling and data-driven. The revenue diversification, the sponsorship expansion, the franchise valuation increases, these are real and substantial.

But the most successful projects I’ve witnessed aren’t driven purely by financial optimization. They’re driven by organizations that recognize they have an opportunity to fundamentally strengthen their connection with their community.

When done well, these districts become genuine civic infrastructure. They create jobs. They transform blighted areas into vibrant neighborhoods. They provide public gathering spaces that activate social connection beyond just game days. They demonstrate that a sports franchise can be a true community asset rather than just entertainment programming.

The teams that lead with this understanding tend to navigate the development complexities more effectively. They build genuine political capital. They create partnerships that withstand inevitable challenges. And they end up with districts that people actually want to spend time in.

Evolution: What’s Coming Next for Sports-Anchored Mixed-Use Districts?

Looking ahead, I suspect we’re still in the early innings of this trend. Current projects blend sports venues with relatively conventional mixed-use elements, retail, hospitality, residential, office. The next generation will likely push further into experiential programming, community infrastructure, and civic partnerships that blur the lines even more completely.

We’re already seeing hints: Jacksonville’s proposed NFL stadium renovation includes a “public wellness loop” promoting community health. NYCFC’s Etihad Park in Queens integrates 2,500 affordable housing units and new public infrastructure. These projects recognize that the most successful districts don’t just extract value from their communities, they contribute meaningfully to urban fabric.

The stakes are significant. Teams that execute these developments well will enjoy revenue streams and franchise valuations that leave traditionally-structured competitors behind. Those that rush in without proper planning will struggle with expensive real estate that fails to activate, sponsorship inventory that sits unsold, and community relationships that sour.

The difference comes down to whether organizations treat mixed-use development as a real estate transaction or as an extension of everything they’ve learned about creating compelling experiences for their audiences. The blueprint exists. The financial models are proven. The question is whether leadership will invest the strategic thinking required to execute at the highest level.

John Roberson is CEO of Advent, a Nashville-based experience design agency that has created storytelling environments for professional sports organizations, academic institutions, and Fortune 500 companies for over 25 years.